Investing in gold ETFs (exchange-traded fund) is a simple and affordable way to gain exposure to gold. With over $100 billion in AUM, many investors rely on these products every day. They’re wildly popular due to the ample selection and the simplicity of buying and selling them right in a brokerage account.

A Short History of Gold ETFs

People have valued gold for thousands of years. Historical societies pursued it to add to existing riches and people owned it as a store of value, long before stocks and bonds were available. However, owning gold meant storage and security issues. Owners of gold must store and secure the metal which can be a hassle to some.

Only in the early 1970s, with the availability of gold futures, could an investor buy gold and not worry about storage. For example, up until the CME launched the gold future, if an investor wanted to incorporate gold into their investment portfolio they were limited to holding the physical metal. Yes, they could buy stock in a gold mining company before the 1970s, but the value of those stocks don’t necessarily track the price of gold. Fortunately, things were about to get much easier for investors everywhere.

2004 witnessed the launch of the first gold ETF, the SPDR Gold Shares (GLD). An instant hit with investors, the SPDR Gold Shares ETF grew in size substantially with many imitator funds to follow. Since the early 2000s, gold, silver and precious metals mining company ETFs have become increasingly popular among investors seeking exposure to gold and silver.

The launch of the SPDR Gold Shares ETF provided investors with a simple and low-cost way to invest in gold. Investors had to buy physical gold coins or gold bars (complicated) or buy gold futures (requires large sums) before this ETF’s launch. Or, they needed to buy futures contracts which typically isn’t appropriate for a new investor or one without large amounts of money to invest.

What IS an ETF?

An ETF, which stands for exchange-traded fund, is quite similar to a mutual fund with few differences. As stated on the Charles Schwab website “ETFs or “exchange-traded funds” are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF, you get a bundle of assets you can buy and sell during market hours…”.

For typical investors, the only differences worth highlighting is that ETFs can be purchased (or sold) at any point during the trading day whereas an order to buy or sell a mutual fund is executed at the end of the day. Second, ETFs can be purchased in much smaller amounts whereas a mutual fund will typically have a minimum purchase amount of $2,500.

What Types of Gold ETFs Are Available?

Gold and silver ETFs come in a variety of flavors, depending on what qualities you’re looking for. For example, do you care about lots of liquidity? In other words, is your priority that the ETF trades A LOT and is always priced accurately compared to the spot gold price? Or, do you want to be able to convert your ETF shares into physical gold? Different ETFs offer different advantages.

For example, the grandfather of them all, the SPDR Gold Shares, is huge. With over $60B in assets under management it remains the largest gold ETF in existence. Furthermore, it very accurately tracks the price of gold and has ample liquidity. For this reason, large investors strongly favor GLD.

However, some investors want the option to take physical delivery of their gold inside the ETF. If that’s the case then you’ll need an ETF with that optionality and not all ETFs offer this. If physical delivery is important to you, then consider an ETF like the VanEck Merk Gold Trust (OUNZ). OUNZ’s ability to let you take physical delivery is a pretty neat feature, it’s a small ETF with less than $1B in assets but it does have one of the lower expense ratios.

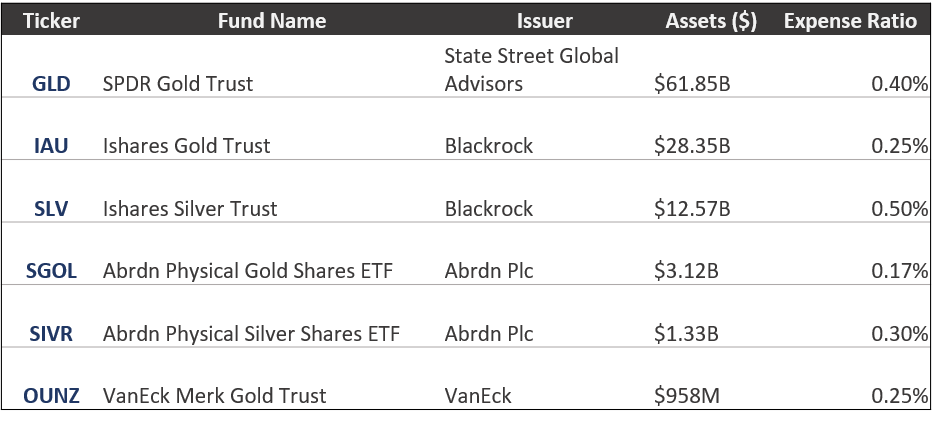

Largest and Most Common Gold and Silver ETFs

Investors have multiple options to choose from when buying a precious metals ETF. They are available for gold, silver and even platinum or palladium. Many of the larger ETFs are quite liquid and easy to buy and sell with prices mirroring their underlying commodity. Many of the world’s largest financial companies issue gold and silver ETFs.

Buying a Gold or Silver ETF

Overall, investing in a gold ETF can be a smart option for any investor. Especially if you’re looking to seek added diversification and gain exposure to gold without physical ownership. However, like any investment it’s important to carefully consider the pros and cons and educate yourself before making a decision.

Pros

- Diversification: Gold ETFs offer investors exposure to the price movements of gold without needing to directly own physical gold. This allows for diversification within a portfolio since gold and silver rarely move in-step with stock prices.

- Liquidity: Gold ETFs trade on stock exchanges, making them highly liquid investments. Investors can buy and sell shares throughout the trading day at market prices.

- Lower costs: Investing in a gold ETF typically involves lower costs compared to buying and storing physical gold. There are no expenses related to storage, insurance, or transportation.

- Transparency: The value of a gold ETF directly tracks the price of gold. This is easily verified and investors can monitor the performance of their investment online.

- Accessibility: Gold ETFs are accessible to any investor, large or small. Investors can purchase gold ETFs inside an IRA, HSAs or a standard brokerage account.

Cons

- No physical ownership: Investing in a gold ETF means you don’t own physical gold. Some investors prefer the tangibility and security of holding physical assets.

- Counterparty risk: While gold ETFs aim to track the price of gold, they are still financial instruments and are subject to counterparty risk. If the issuer of the ETF encounters financial difficulties, it could affect the value of the investment.

- Tax implications: Depending on your jurisdiction, investing in a gold ETF may have tax implications. It’s important to understand the tax treatment of any investment before making a decision.

Conclusion

Ultimately, for most investors buying a gold or silver ETF is the easiest and most efficient option. These ETFs have become quite large with lots of liquidity. Additionally, they are inexpensive and accurately track the price of gold or silver with near perfection.

Some investors value being able to own physical gold or silver and doing so can be a wonderful idea. However, if that’s not important to you then and ETF will be less work, more convenient and accomplish the same investing and diversification goals. Lastly, if an investor is looking to buy the shares of gold mining companies, then there are separate gold mining company ETFs to consider.

Author

Andrew McCormick, RIA is the Senior Portfolio Manager at Cottonwood Capital Management. Previously, he worked for BlackRock and managed the MKC Global Fund, LP. Andrew’s work has been featured in ZeroHedge, TheStreet, and the Wall Street Journal.