Introduction

The late 1960s and 1970s were transformative years for the gold market and precious metals investing. They were marked by significant economic, political, and monetary changes. Furthermore, this period witnessed a substantial shift in the role of gold in the global financial system, influencing both institutional and individual investors. This article delves into the key events, market dynamics, and investor strategies that defined gold in the 1970s and investing during this period.

Up until 1971 the Bretton Woods Agreement governed the global financial system. Established in 1944, this system pegged major currencies to the US dollar, which in turn was convertible to gold at a fixed rate of $35 per ounce. Gold played a central role in maintaining international economic stability, with central banks holding substantial gold reserves to back their currencies. Most Americans know this period simply as the gold standard.

To maintain the fixed gold price, the US and several European nations formed the London Gold Pool in 1961. This collaborative effort aimed to regulate the gold market by coordinating the sale of gold reserves to stabilize its price. Despite these efforts, speculative attacks on the US dollar and increasing demand for gold strained the pool’s effectiveness.

As the 1960s neared an end, confidence in the US dollar and the fixed gold price began to erode. The US’s gold reserves dwindled as other countries increasingly demanded gold in exchange for their dollars. This eroding confidence culminated in the collapse of the London Gold Pool in 1968, signaling a major turning point in the gold market.

The Two-Tier Gold Market

In response to the collapse, a two-tier gold market was established in March 1968. Central banks continued to trade gold among themselves at the fixed price, while private investors traded gold at fluctuating market prices. This dual system marked the beginning of the transition away from the Bretton Woods system and the fixed gold price. Specifically, in 1968 the informal market for gold saw the price trade up to $41/oz. from $35 before returning to that level the following year.

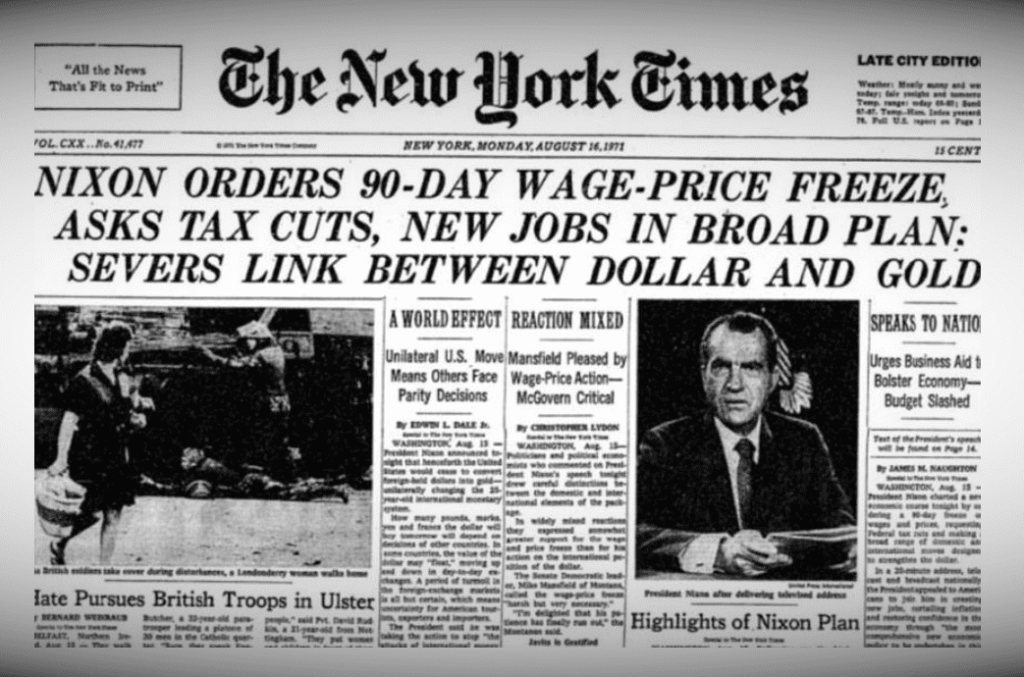

A Free-Floating U.S. Dollar

In August 1971, President Richard Nixon announced the suspension of the US dollar’s convertibility into gold, a move known as the “Nixon Shock.” This effectively ended the Bretton Woods system and led to the devaluation of the US dollar. By 1973, major currencies began to float freely against each other, and gold was no longer tied to a fixed price. For investors, this marked the beginning of a new era of gold trading.

A Historical Gold Bull Market

The removal of the gold standard unleashed gold from its fixed price constraints, leading to a surge in its market price. Due to this, economic instability, high inflation, and geopolitical tensions further fueled demand for gold as a safe-haven asset. The price of gold skyrocketed, reaching unprecedented levels by the end of the decade. From around $35 per ounce in 1971, gold surged to over $800 per ounce by January 1980. This 20x move in the price of gold contrasts sharply with the performance of the Dow Jones Industrial Average which remained mostly unchanged in nominal terms and declined sharply in real terms.

Investment Strategies

During the 1970s, gold became an attractive investment for both institutional and individual investors seeking to hedge against inflation and currency devaluation. Ultimately, the decade saw the emergence of new investment vehicles, such as gold futures and options. These new vehicles provided investors with more sophisticated tools for trading and risk management. Additionally, gold mining stocks and mutual funds became popular ways for investors to gain exposure to the gold market.

Investors employed various strategies to capitalize on this bull market:

Physical Gold: Buying and holding physical gold in the form of bars and coins became a popular strategy. Investors valued physical gold for its tangibility and direct ownership.

Gold Futures and Options: The introduction of silver futures in 1970 and gold futures in December 1974 provided a sophisticated tool for traders. Futures contracts allowed investors to speculate on future price movements, while options offered a way to hedge and manage risk.

Gold Mining Stocks: Investing in gold mining companies offered leveraged exposure to gold prices. As gold prices rose, mining stocks often provided outsized returns.

Mutual Funds and ETFs: Exchange-traded funds (ETFs) were not yet available in the 1970s. However, mutual funds focusing on precious metals and mining stocks became popular and offered diversified exposure to the gold market.

Silver: The Poor Man’s Gold

Silver, often referred to as the “poor man’s gold,” also experienced significant price movements during the 1970s. Its prices were influenced by many of the same factors driving gold, including inflation and economic uncertainty. However, silver’s industrial applications added an additional layer of demand.

The Hunt Brothers Try to Corner the Silver Market

One of the most dramatic events in the silver market was captained by the Hunt brothers: Nelson Bunker Hunt and William Herbert Hunt. They attempted to corner the silver market in the late 1970s by accumulating massive amounts of silver. In all, their efforts helped to drive prices from around $6 per ounce in early 1979 to nearly $50 per ounce by January 1980.

This speculative frenzy attracted many investors and traders, hoping to ride the wave of skyrocketing silver prices. However, the subsequent collapse of the silver market, known as “Silver Thursday” in March 1980, led to substantial losses for many.

Contrasting the Stock Market Versus Gold

The 1970s was a difficult period for the stock market as it faced many separate and formidable headwinds. First, the 1950s and 1960s witnessed a very strong bull market for stocks, but one that would not last forever. The result of a 20+ year bull market was high stock prices that were fully valued and prone to price corrections. Second, inflation and geopolitical issues were a strong catalyst to unwind the high valuations enjoyed by stocks.

1968-1982 played host to a painful bear market when adjusting for inflation. Specifically, the value of the S&P 500 declined by approximately 65% over this period when including the effect of inflation. Contrast this performance to that of precious metals investors who were able to hedge against the impact of this monetary inflation. Instead of painful bear market, they enjoyed a substantial rise in the value of their holdings of gold, silver, and even copper. Early buy-and-hold investors saw a 20x rise in the value of gold.

Author

Andrew McCormick, RIA is the Senior Portfolio Manager at Cottonwood Capital Management. Previously, he worked for BlackRock and managed the MKC Global Fund, LP. Andrew’s work has been featured in ZeroHedge, TheStreet, and the Wall Street Journal.