Summary

- How to invest in gold through your brokerage account: ETFs like OUNZ or GLD are a great place to start

- Or, purchase gold coins and silver bars from a reputable online precious metals dealer

Gold stands alone throughout history as the most desired and sought-after asset. Little has changed in today’s modern world.

For thousands of years people have pursued gold for its value and beauty; civilizations have waged wars in pursuit of gold and man has, at times, risked everything to explore for new sources. Mankind has continually understood that gold is a store of wealth. Unlike any other asset it has preserved wealth effectively, century after century.

Historically, the desire to invest in gold tends to fluctuate along with its price, the urge to acquire it during periods of rising gold prices is a feeling many investors know. However, although the interest in gold may lessen during periods of price declines, even when gold prices drop investors often see these times as opportunities to increase holdings while gold is “on sale”.

For a newcomer to the precious metals market, what’s the best way to invest in gold or silver?

There are two different answers for the two different types of investors; specifically, do you want to own (and hold) physical gold or do you simply want to benefit financially from a rising gold price (buy an ETF)?

How to Invest in Gold and Silver with ETFs:

- Buy a gold or silver ETF through a brokerage account

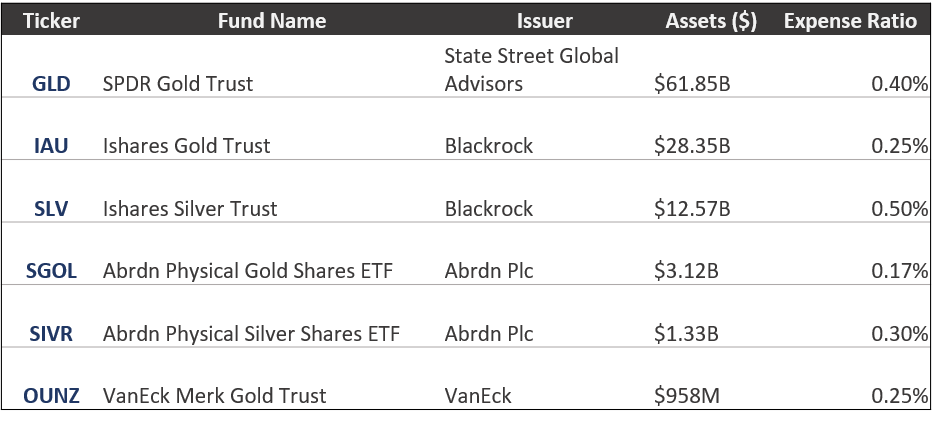

- ETFs like OUNZ or GLD are a popular choices, SLV is available for silver

Unlike in prior gold cycles, like the 1970s, investing in gold or silver is now very simple. Through a brokerage account, like one with Charles Schwab, Merrill Lynch, or RobinHood, investors can simply purchase a gold or silver ETF the same way they would buy stock in a company or another type of ETF.

Many reputable investment companies have precious metals ETF products, all should be safe and be backed by physical gold bars in a secure vault. They often hold gold with HSBC in a secure warehouse, make daily holding statements and are audited on an annual basis. This makes investing in gold or silver nearly effortless and quite effective.

An investor considering one of these funds can have the confidence knowing that some of the largest investors in the world use these funds to gain exposure to precious metals. For example, the two largest gold ETFs have a combined $90 billion dollar in gold holdings.

The SPDR Gold Trust (aka GLD) is the granddaddy of the gold ETFs, it launched before any of the competition back in 2006. As of mid-2024 it holds about $66B in gold for its investors.

Some of the most popular and most liquid gold and silver ETFs can be found below:

Pros:

- Simple and fast

- Effective capture of gold’s price movement

Cons:

- Don’t have physical possession of your gold or silver

How to Invest in Gold and Silver (I Want to Touch it!):

- How to invest in gold with coins or silver bars from a reputable online precious metals dealer

- Many online dealers are reputable and make the buying/selling process quite easy

I’ve invested in gold for many years but only bought my first gold coin in 2023. Really, it is fun to hold an ounce of gold – it’s beautiful and collecting coins can be a great way to add some fun to the investing process.

One of the reasons many people prefer, or at least are more comfortable with, investing in real estate instead of stocks is because they can touch it. It fells real to them.

Buying physical gold coins or silver bars is no different, you know it’s real and there’s definitely a satisfaction to holding your own physical metal. Investors simply need to find a reputable online precious metals dealer, or if preferred, a local coin shop.

The drawbacks are:

- Additional work and time

- More complicated to buy and sell

- Some risk to authenticity

- Secure storage or risk of theft or loss

Buying Gold Coins or Silver Bars Take More Time

The gold and silver bullion and coin market is diverse and contains many exciting options. Investors can buy coins or bars with multiple types and styles of each. Coins come from many different countries, in many different weights and designs. Bars come in many different weights, styles, and from numerous different mints around the world.

Making your selection of type and style takes some decision making, as does the particular dealer you will buy from. In addition, once purchased, a buyer will need to wait for the product to ship. In all, the time is not extensive but is longer than simply buying an ETF in a brokerage account, which can be done in mere minutes.

Risk of Fraud

Although unusual, there have been reports over the years of fake gold bars. Criminals have hollowed out a gold bar and filled it with tungsten, a metal with a similar density. Many fewer examples exist of tampering with coins as they’re small and so detailed that tampering with them is difficult and not worth the effort.

Fortunately, reputable gold dealers verify the purity of products sold through sophisticated methods, such as weighing, electronic testing, ultrasonic testing, and other methods.

Buying a gold or silver coin from a reputable dealer is often a very safe activity.

Storage of Precious Metals

My feeling is that investors get too focused on the storage issue. Unless you are running a large fund or are incredibly wealthy, the amount of gold coins you will own will likely be relatively small. A one-ounce gold coin is a bit bigger than a quarter and smaller than a silver dollar.

For a long time I kept mine in my office drawer because I liked to look at it on occasion (I’ve stepped up security since!). Even if you have 20 or 30 they’ll fit in a tube and can be easily hidden or placed in a small lock box or safe. For nearly all individual investors storing gold and silver is a simple task. Don’t talk about what you own any more than you need to and you shouldn’t have any problems.

Pros:

- Guaranteed capture of gold’s price movement

- Physically possess your gold or silver

- Possessing physical gold can help encourage long-term investing

Cons:

- Added work and time to buy and sell

- Potential security concerns

How to Invest in Gold (and Silver) – Final Thoughts

Buying gold or silver as an investment can be very simple and quick. If an investor wants to physically hold their gold or silver a little more time will be needed but often times investors find this additional time well worth it.

Understanding how to invest in gold and silver is critical to preserving wealth in an inflationary environment. Historically, owning gold over the long-term has been a smart investment. Precious metals often have very little correlation with the stock or real estate markets and offer an efficient way to diversify an investment portfolio.

Author

Andrew McCormick, RIA is the Senior Portfolio Manager at Cottonwood Capital Management. Previously, he worked for BlackRock and managed the MKC Global Fund, LP. Andrew’s work has been featured in ZeroHedge, TheStreet, and the Wall Street Journal.