Finding a trustworthy and professional dealer is critical when choosing to buy gold. Knowing that, if you’re going to purchase online then such an important financial decision needs to be done with one of the best online gold dealers, period.

Few investors know the pleasure of being able to hold a genuine investment in their hands, take the U.S. gold buffalo for instance – it’s beautiful. Conversely, stocks, bonds, and even gold ETFs held in your brokerage account, just don’t compare.

Here at GoldSentiment we’ve done the research and sorting for you. Our methodology (detailed below) covers different aspects of the research process such as: consumer reviews, business volume, customer hold times, shipping time, customer service experience, selection, corporate ownership, and more.

Knowing the overwhelmingly large selection of online gold and silver dealers, we wanted to create a helpful source for investors to reference. With this goal in mind, we combed through the near-countless options available and found our five favorite online gold dealers for you to shop with confidence.

The 5 Best Online Gold Dealers of 2025

(Updated as of 2/3/2025)

- JM Bullion – Favorite overall gold dealer

- Silver Gold Bull – Veteran seller with long history

- SD Bullion – Strong operational transparency

- Golden Eagle Coins – Family-owned operation with solid offerings

- BGASC – Great reviews, publicly owned

Whether you’re looking to make a first purchase of a gold coin, gold bar, silver or if you’re simply adding to an established collection, take the time to read each review of our top-rated online dealers before you make another purchase.

In sum, each of these online precious metals dealers should be able to provide what you’re looking for, offer great customer service and move you forward in your investment goals.

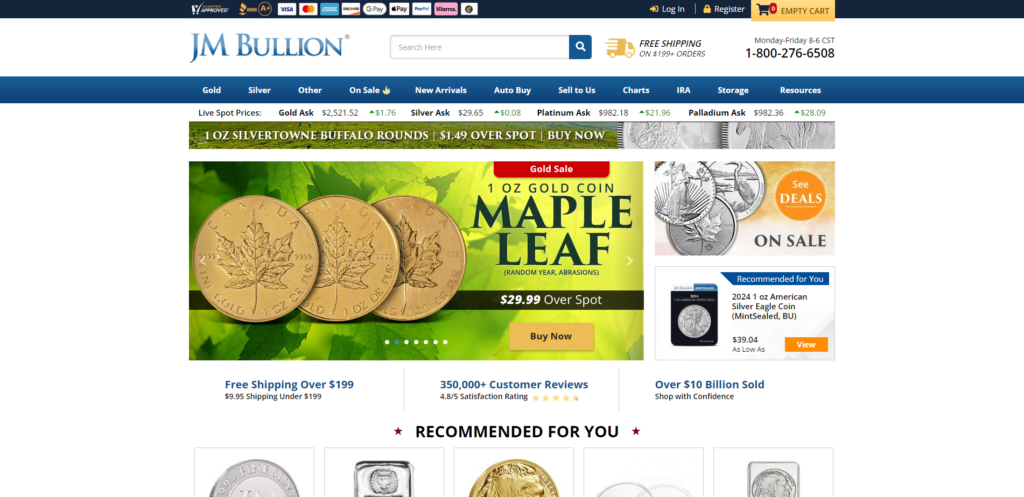

#1 JM Bullion

Best Overall Online Gold Dealer

Pricing from $1.49 over spot silver and $29.99 over spot gold

JM Bullion

Best Overall Online Gold Dealer

Excellent

Pros

Cons

JM Bullion Features

JM Bullion is our top-rated online precious metals dealer, among numerous competitors, with a score of 4.7 out of 5. We break down the company’s offerings in detail and provide a history and description of the company below. Take a look below:

Pros

Cons

Located in Dallas, TX

Higher cost for using a credit card or PayPal

Owned by A-Mark Precious Metals, a public company

Minimum $1,000 value for buy-back program

BBB A+ rated

Offers platinum, palladium, gold and silver

No minimum order size

Precious metals IRA program available

100% 5-business day return policy

Secure storage offerings available: Las Vegas, Toronto, Zurich, and Singapore

JM Bullion Company Background

JM Bullion started in 2011 by two founders and quickly grew the company. By undercutting their competition on price they quickly had their first $100,000 sales day a year after launch and their first $1,000,000 sales day in 2013. Growth only continued and, according to their website, 2020 saw sales in excess of $1B. Although this can’t be verified independently it does make sense as JM Bullion is the second most trafficked online bullion website.

JM Bullion Highlights

In addition, JM’s tremendous growth got the attention of A-Mark Precious Metals, a leading wholesale bullion distributor, who acquired them in 2021 for approximately $180m. Although not widely known, they are a publicly-traded company (AMRK) with a market cap of over $800m as of 2024. Being owned by a publicly-traded company adds a meaningful degree of transparency and legitimacy to any organization. A-Mark Precious Metals-owned dealers typically get a small ratings boost within out methodology due to the stringent reporting requirements and the increased transparency required of public companies.

Finally, along with other advantages, a large gold dealer will often be able to maintain stock in a greater number of items. The advantage of scale economies allow them to maintain this stock, maintain better wholesaler relationships, and process orders and manage shipping in a more streamlined manner.

In summary, JM Bullion provides nearly every product and service that a precious metals investor might want or need. Both seasoned collectors of gold and silver and also new buyers should find JM Bullion to meet their needs with competitive pricing and a large selection of product. Their 13+ years in business and clear market share should give confidence to anyone considering purchasing from them in the future.

JM Bullion is our top-rated online gold dealer, scoring 4.7 out of 5

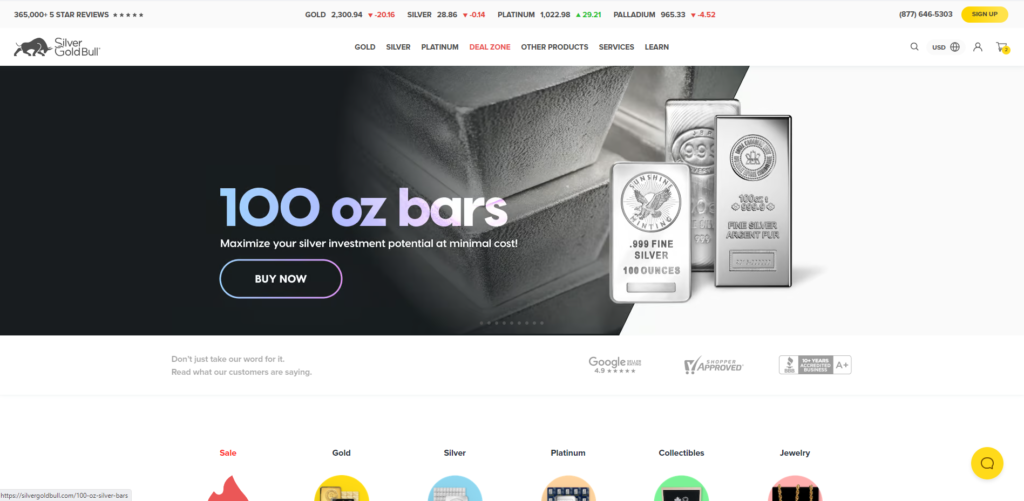

#2 Silver Gold Bull

Excellent dealer and user interface

Pricing from $1.49 over spot silver and $29.99 over spot gold

Silver Gold Bull

Excellent website and strong service offering

Great

Pros

Cons

Silver Gold Bull’s Features

Silver Gold Bull easily makes our top five, even amid stiff competition and great product offerings from other companies, our methodology generated a score of 4.1 out of 5. Look below for a complete summary of the company’s offerings and services:

Pros

Cons

Located in Las Vegas, NV

Higher cost for using a credit card or PayPal

A-Mark Precious Metals now a 55.4% owner

Less common products may have limited availability

TrustPilot.com rating of 4.8/5

Bug bounty program

24K gold jewelry offering

Price match guarantee

Military discount and accepts crypto

Brinks secure storage available: 6 locations across 4 countries

Company Background

Silver Gold Bull launched way back in 2009 in Calgary, Canada by Bobby Belandis. Fifteen years and millions of dollars of transactions later Silver Gold Bull has now partnered with A-Mark Precious Metals, a U.S. public company. As a 55.4% owner of Silver Gold Bull, A-Mark adds a new layer of financial backing, credibility, and transparency to what was already a stable company within the field.

Others have notices SGB too, customers have voted and have made clear their approval and appreciation of this company. Silver Gold Bull has a lofty 4.8 rating on Trust Pilot, a BBB A+ rating, 5/5 on ShopperApproved.com and handles well over 100,000 visitors every month.

Silver Gold Bull Highlights

SGB’s large and growing industry footprint hasn’t been an accident. Customers continue to return because of Silver Gold Bull’s wide array of services, products, and competitive business practices. For example, members of the military receive a discount on each order and they have a price match guarantee which means they will not be undersold.

Additionally, Silver Gold Bull is looking to compete by offering a gold IRA program, allocated Brinks storage services, and even 24k gold jewelry for those looking to wear their precious metals instead of locking them away in a safe.

Also, we appreciate that they have a bug bounty program, something that we haven’t seen before with an online gold dealer. This program is a sign that the company takes their online security seriously. By paying developers, engineers, and would-be-hackers to inform the company of any technology vulnerabilities instead of exploiting them, they turn what could be a danger (getting hacked) into a strength (a decentralized tech army hunting for vulnerabilities in exchange for cash).

Lastly, we appreciate their impeccable web design, interface, and usability. Their site is a pleasure to navigate and adds to what is already a strong customer experience.

**Deal Alert**

***Deal Alert (when not sold out)*** Silver Gold Bull is best known for their popular 10oz silver bar at spot price deal. The 10 oz silver bar features the dealer’s “charging bull” logo and is minted by Sunshine Mint, a leading refinery (that is also owned by A-Mark). The Sunshine Mint is one of the companies responsible for supplying 1 oz silver coin planchets that are used in the manufacturing of American Silver Eagle coins.

Ultimately, Silver Gold Bull is a wonderful option for anyone looking to purchase precious metals online. Although not in the top spot on our top 5 list, SGB should definitely be considered when evaluating the different options. Their strong financial backing and outstanding online reviews mean that this retailer is trusted and a strong contender in the industry. Their website feels the most modern with an advanced UX that shoppers will undoubtedly enjoy.

Silver Gold Bull ranks second on our list, coming in just after JM Bullion with a score of 4.4 out of 5

#3 SD Bullion

Low-Price Leader

Pricing from $1.49 over spot silver and $29.99 over spot gold

SD Bullion

Consistent low prices and great selection

Very Good

Pros

Cons

SD Bullion’s Features

SD Bullion has secured our #3 spot for it’s long history, low prices, and great selection. They are a very strong competitor with a score of 4.3 out of 5. We break down the company’s offerings in detail and provide a history and description of the company below. Take a look below:

Pros

Cons

Located in Toledo, OH

Higher cost for using a credit card or PayPal

Largest independently-owned online gold dealer

Minimum 20oz for silver buy-back program

BBB A+ rated

Offers platinum, palladium, copper, gold and silver

24k jewelry selection

Precious metals IRA program available

100% 3-business day return policy

Secure on-site storage for as low as $9.99/mo

SD Bullion Company Background and Highlights

SD Bullion’s 12+ year history as a top precious metals dealer isn’t surprising. After all, their early motto was “Nothing fancy. Just a telephone and low prices.”. It’s hard to argue with a return to the basics and a focus on what customers need.

Launched by two doctors back in 2012, SD Bullion grew through simplicity and very competitive prices – a strategy still in use today. By now they’ve shipped more than 1,500,000 orders for more than $4.5B in transactions. Earnst & Young (EY), one of the country’s largest accounting firms, has voted Tyler Wall (one of the founders) Entrepreneur of the Year.

SD Bullion Highlights

Founder (and CEO at the time), Tyler Wall, spoke with Bloomberg during 2022’s period of silver volatility. An accessible and knowledgeable CEO, he’s proven willing to speak with the financial media, publish video content for the company and even provide a video tour of their vault and warehouse operations.

Ultimately, SD Bullion compares similarly to the other top-grade online gold dealers. For example, their online reviews reflect a customer base that continues to be pleased with their products and services. Also, their selection appears to be stronger than others with more skews in-stock, including 24k jewelry. Lastly, SD Bullion appears to be the most competitive pricing. It varies product-to-product and differs by precious metal, but they tend to, on average, maintain the lowest prices.

In summary, SD Bullion offers a wide array of in-stock selection of various metals. By offering gold IRAs, storage, a competitive return policy and strong transparency into ownership and their operations, metals buyers must consider SD Bullion when choosing an online gold dealer. Lastly, their lower prices alone warrant consideration and perspective customers should review their warehouse video to see their inner workings.

SD Bullion is our 3rd top-rated online gold dealer, ranked just after Silver Gold Bull, with a score of 4.3 out of 5

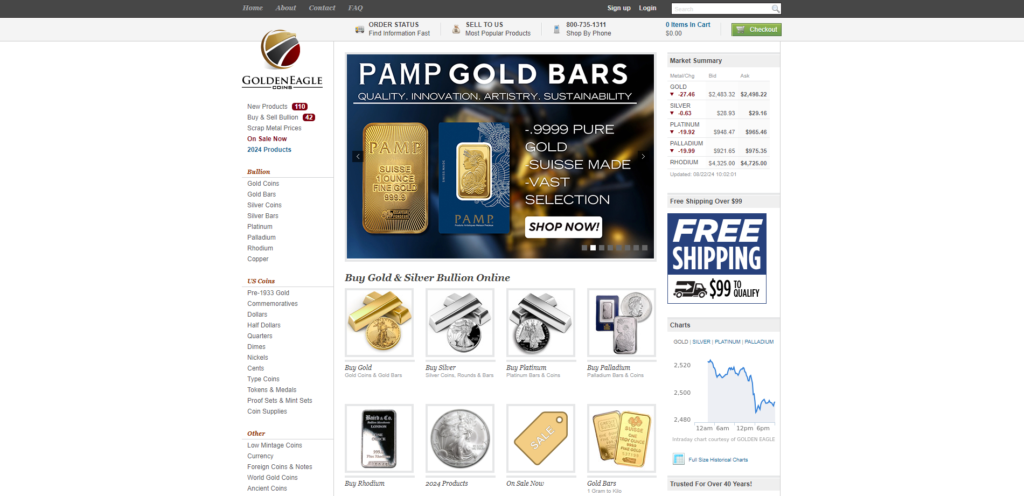

#4 Golden Eagle Coins

Oldest of the online dealers

Free shipping on order over $99

Golden Eagle Coins

Basic website with a brick-n-mortar store

Strong Offering

Pros

Cons

Golden Eagle Coin’s Features

Golden Eagle Coins is our #4 online precious metals dealer with a score of 3.9 out of 5. Although they are a trusted retailer with a strong product selection, they do offer slightly fewer services than their higher-rated peers it’s advised that perspective buyers review the company’s pros and cons before moving forward. Buyers in search of a straightforward purchase will be well-served to consider Golden Eagle Coins when purchasing coins or bars.

Pros

Cons

Located in Laurel, MD

Credit cards only allowed on orders under $1,500

Family owned & operated for 50 years

Web 1.0 feel to website

BBB A+ rated

No storage options available

Offers rhodium, when in stock

No precious metals IRA options

Free shipping on orders over $99

No returns on bullion

Strong customer satisfaction

Competitive pricing, undercutting other dealers

Interesting selection of Roman and Greek coins

Company Background and Highlights

Golden Eagle Coins (GEC) launched way back in 1974 which makes them the grandfather of the online gold dealers. Launched over 50 years ago, they are (according to them) the largest coin and bullion dealer in the Washington D.C. area and have a strong selection of gold, silver, platinum, palladium, some copper, and rhodium (when available).

Golden Eagle Coins Highlights

Shopping GEC’s website is straightforward and simple, although it does feel like a site that hasn’t been brought up to current UX standards or what you would find from its competitors. Its somewhat dated feel doesn’t impact the purchasing process but, compared to a site like Silver Gold Bull’s, it can feel slightly unprofessional in today’s era of Web3.0.

However, fancy website or not, GEC pulls its weight in web traffic and pulls in about 90,000 visitors a month and has a brick-and-mortar location in Maryland. Additionally, customer satisfaction remains the true indicator of success and customers on Google, Ebay, TrustPilot, and ShopperVerified all seem to think they provide valuable service and quality products.

Moreover, in regard to competitive pricing, GEC holds its own and ranks right up with SD Bullion in terms of their low premiums over spot. Premiums do vary by product and metal, but currently they have the lowest premium for 1oz silver Maple Leaf coins.

Lastly, being in business for over 50 years and the transparency of a physical store location coupled with very competitive pricing should motivate any serious buyer to consider Golden Eagle Coins when planning a purchase.

In summary, Golden Eagle Coins provides basic services and does them quite well, particularly for the budget-conscious buyer. Specifically, they maintain the lowest free shipping threshold and have some of the lowest premium (depending on product). Basically, if you aren’t looking for additional services like storage or a precious metals IRA GEC might be the best option available. After all, if a company’s been in business for 50+ years it probably means they’re doing something right.

Golden Eagle Coins ranks behind SD Bullion with a score of 3.9 out of 5

#5 BGASC

Large selection, strong ownership, but higher silver premiums

Pricing from $1.49 over spot silver and $29.99 over spot gold

BGASC

Industry staple with great selection

Good

Pros

Cons

BGASC’s Features

BGASC rounds out our top 5 list, coming in last at #5 with a score of 3.7. Recently acquired by JM Bullion in 2022, BGASC enjoys the strong financial backing and unbeatable network of A-Mark Precious Metals. Important to note, they do offer many of the same products and services as many of the other dealers on this list but do have higher premiums for some staple silver coins. Although, to be fair, their premiums for gold coins (U.S. gold buffalo, for instance) is actually quite competitive. A full description of the company can be found below.

Pros

Cons

Headquarters in Dallas, TX and distribution in Las Vegas, NV.

Higher cost for using a credit card or PayPal

Owned by A-Mark Precious Metals, a public company

Minimum $1,000 value for buy-back program

BBB A+ rated

$199 order minimum for free shipping

Offers platinum, palladium, copper, gold and silver

No storage available

Military discount available

Precious metals IRA program available

100% 5-business day return policy

Secure storage offerings available: Las Vegas, Toronto, Zurich, and Singapore

BGASC Company Background

BGASC brings a strong offering to the table for gold and silver investors. Currently owned by our #1 ranked company, JM Bullion, BGASC also enjoys the financial backing of A-Mark precious metals. As a public company, A-Mark (and by extension, BGASC) benefits from their large industry footprint and relationships with Sunshine Mint, integrated storage options, and more.

BGASC Highlights

Next, with almost 100,000 visitors a day BGASC is no small operation. After all, JM Bullion made moves to acquire them in 2022 due to their growth, offerings, and customer loyalty. Speaking of customer loyalty, BGASC has some of the best reviews of anyone on our list: 4.5/5 BBB A+, 4.8/5 TrustPilot, and 4.9/5 on Google.

Additionally, although released back in 2014, they did release an informational video showing their BGASC’s warehouse and logistics operation, this type of transparency is appreciated and helps perspective clients gain a level of confidence and comfort before conducting business.

Lastly, BGASC does not offer an easy and integrated precious metals storage option, although they will work with your precious metals IRA custodian and your choice of approved storage location.

Final thoughts:

BGASC offers nearly everything a precious metals buyer might want. Due to this, shopping with them feels very straightforward: no frills, strong product availability and, depending on the product, low premiums. In all, BGASC captures a good portion of the online precious metals trade for good reason. For this reason, customers have voted online and their reviews indicate what we’ve found – that BGASC deserves a spot in a top 5 list.

BGASC rounds out our top 5 list, coming in last with a score of 3.7 out of 5

Investing in precious metals and precious metals IRAs are an investment and carry risk. Consumers should be alert to claims that customers can make a lot of money in these or any investment with little risk. As with any investment, you can lose money and past performance is not a guarantee of future performance results. Consumers should also obtain a clear understanding of the fees associated with any investment before agreeing to invest.

Author

Andrew McCormick, RIA is the Senior Portfolio Manager at Cottonwood Capital Management. Previously, he worked for BlackRock and managed the MKC Global Fund, LP. Andrew’s work has been featured in ZeroHedge, TheStreet, and the Wall Street Journal.