Gold royalty companies make up a small but important slice of the precious metals market. These wonderful companies allow you to invest in gold and silver through the convenience of your brokerage account. In addition, gold and silver royalty companies have historically generated higher returns than gold ETFs, mining stocks, or physical bullion.

What is a Gold Royalty Company?

Quite simply, gold royalty companies lend money to mining companies in exchange for a percentage of physical gold extracted from the mine. These companies have the distinct advantage of not needing to buy land, develop a mine, or purchase and maintain machinery.

A gold royalty is a contract that gives the owner (i.e. a gold royalty company) the right to a percentage of gold production or revenue in exchange for an upfront payment.

Gold royalty companies use these contracts as a way to finance mining companies in need of capital. In exchange, they receive a percent (“stream”) of the mined metal. Often, this stream will last for the entire life of the mine, which can be as long as 20+ years.

Sandstorm Gold describes the business clearly:

“This alternative form of mine financing is often more attractive than traditional debt or issuing equity – particularly in the current era where gold mining stocks haven’t been particularly profitable investments relative to the price of gold. As a result, their share prices have disappointed investors for many years. Gold royalty companies will also purchase pre-existing royalties as a way to build a diversified portfolio of royalty assets. Since royalties typically cover the life of a mine, gold royalty companies benefit from the exploration upside that may extend the life of the mine and thus increase the amount of gold (or revenue) they receive from the mining company at no additional cost.” (Source: Sandstorm Gold)

Gold royalty stocks, due to their focused business, maintain a high correlation to the price of gold and silver. Unfortunately, investors often overlook these interesting companies and seek out gold mining stocks, a gold ETF, or popular physical products like 1 oz gold coins. Investors tend to overlook royalty companies because there are so few of them. Also, they lack the obvious visual cues, such as heavy equipment and smelters. Although some have a very large market cap they all tend to maintain a small employee count.

Key Takeaways

- Gold royalty companies receive a portion of a mine’s production and, therefore, are a great way to invest in precious metals.

- These stocks have historically generated a stronger return than a gold ETF or gold mining stocks.

- Gold and silver royalty companies benefit from not having any capex and maintaining just a handful of employees.

- Historically, gold royalty stocks have been more volatile than the price of gold or silver.

Should Gold Royalty Stocks be in Your Portfolio?

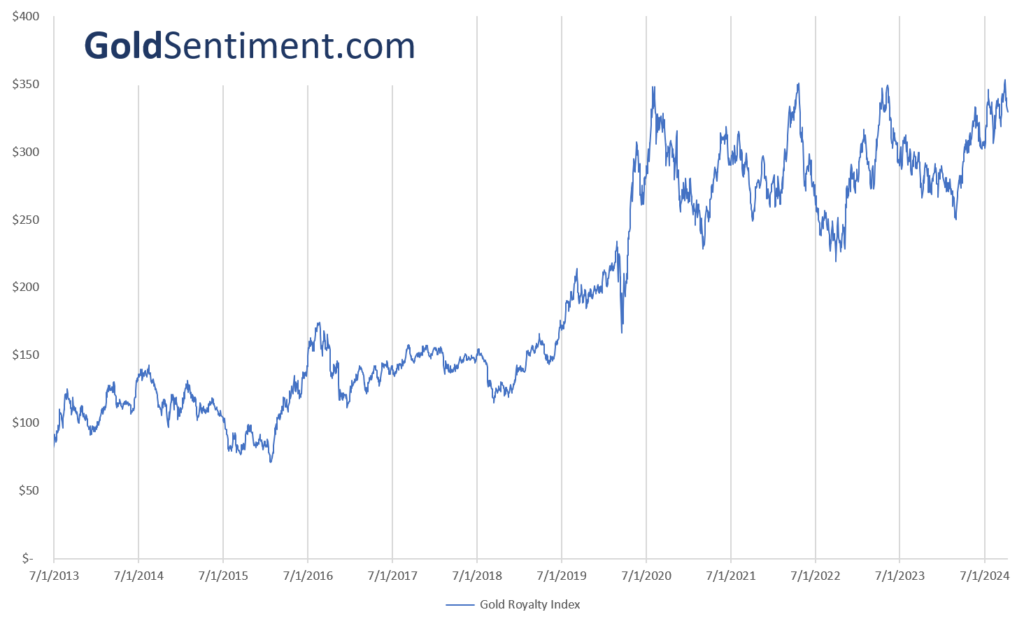

Investors interested in gaining exposure to precious metals may want to consider gold royalty companies. These companies are compelling due to their leveraged nature, lack of required capital expenditures, and lessened exploration and operational risk. The chart below shows their historical performance profile relative to the price of gold:

In my experience as an investor and analyst, gold royalty companies behave differently than the price of gold itself. For example, these stocks tend to exhibit slightly higher volatility than the price of gold. In fact, an investor may feel that their daily, weekly, and monthly volatility compare more closely to silver. Also, their short-term price changes tend to correlate more with the S&P 500 than one might expect.

Lastly, these companies, although potentially wonderful investments, do possess a higher level of risk than simply investing in gold. These companies can, at times, finance unwise operations which ultimately disappoint financially. Alternatively, sovereign or geopolitical risks exist and must be considered. For example, foreign mine becomes nationalized by the local government, seized, or shut down for environmental reasons.

A recent example of this played out with Franco Nevada Corp. (FNV) back in 2023. One of their royalty streams, the Cobre Panama mine had been in the crosshairs of environmental protestors for some time. Many Panamanians argued that First Quantum Minerals obtained their mining permit illegally. They also argue that its location, in an important rain forest, was causing irreversible environmental damage. In 2023, the Panamanian supreme court agreed, and shut down operations.

List of Silver and Gold Royalty Stocks

Precious metals royalty companies fill a small corner of the gold and silver industry. As a result only a handful exist with fewer still of any meaningful market cap. For example, their combined market cap is less than $100B, less than a third of the market cap of Netflix (2024).

In order of market capitalization:

- Wheaton Precious Metals (WPM)

- Franco-Nevada (FNV)

- Royal Gold (RGLD)

- Osisko Gold Royalties (OR)

- Triple Flag Precious Metals (TFPM)

- Sandstorm Gold (SAND)

- Metalla Royalty & Streaming (MTA)

- EMX Royalty (EMX)

- Gold Royalty (GROY)

- Vox Royalty (VOXR.TSX)

Comparing Royalty Stocks to Miners and Gold

Gold Royalty Stocks vs. Gold

Gold royalty companies have three distinct advantages: operating leverage, the duration of their gold streams, and their lack of required capital expenditure. To begin, these companies have tremendous operating leverage sewn into the business model. By funding a mining company’s exploration and operations in exchange for a percentage of revenue they have a fixed outflow of capital (single up-front payment) and retain open-ended upside optionality. The funded site may end up containing reserves in excess of initial forecasts and provide decades of additional gold production.

However, the opposite can occur as well. If a mine fails to discover recoverable reserves the investment may be a partial or total loss. As with any business, diversification helps reduce this risk and many royalty companies do diversify geographically and with different mining companies. Some even diversify across different metals, base and precious.

Gold Royalty Stocks vs. Mining Companies

Compared to a basket of gold mining companies, over the long-term, the share price of gold royalty companies have outperformed. This feature is likely due to the fact that royalty companies have low capital expenditures while retaining the upside of positive exploration surprises. They own no depreciating mining equipment and avoid additional salaries for miners, machine operators, and drivers. They typically write the up-front check and await confirmation of mine production numbers.

Royalty Company Advantages

– Gold stream or share of profits for the life of the mine

– No Capex

– Highest revenue per employee of nearly any industry

– Upside optionality

Two distinct factors drive the historical outperformance of precious metals royalty companies. First, the royalty company benefits when a mine’s exploration activities result in additional discoveries. This potential share accelerant is an infrequent (but meaningful) benefit to the royalty business model. Second, when the gold price declines royalty companies enjoy some insulation due to their lack of capex and payroll. As a result, the share prices of gold royalty companies historically have outperformed those of gold mining companies during periods of a declining gold price.

One caveat to this would be valuation. After a period of outperformance, the valuations of royalty companies could meaningfully exceed that of gold and silver mining companies. The mean reverting nature of valuations could counteract what is otherwise a superior business model. In other words, a mediocre company, if deeply undervalued, can outperform a wonderful company with a severe overvaluation.

Similarly, if gold mining company stocks come back into favor, they may have additional funding options available. If investors desire gold mining stocks, they may also tolerate additional share issuance which could be a cheaper form of financing compared to partnering with a royalty company. Furthermore, increased competition will likely result from a prolonged precious metals bull market. For example, new royalty companies may form and might bid competitively for mining financing opportunities. This competitive bidding would make the business less lucrative.

How do Silver and Gold Royalty Companies Work?

Industrial gold mining is a difficult and capital-intensive business. Large discoveries appear to be increasingly unusual and locating economically-justifiable locations remains a meaningful undertaking. Mining companies spend substantial capital on initial exploration costs which include sampling, geological mapping, and drilling. Once the economics of a site are determined to be worthwhile, miners face particularly massive capital outlays. These include (but aren’t limited to) mine construction, permitting, environmental considerations, project development, and ongoing operations.

Royalty contracts provide a compelling alternative form of financing for mining companies to consider. Without this option, miners would be forced to rely either on traditional debt or on new share issuance. In an environment where gold miners are out-of-favor these can be expensive options to any CEO. Historically, heavy debt loads have been a primary cause of mining company bankruptcies. A heavy debt load, requiring regular principal and interest payments, can cause a liquidity crunch at times when the price of gold declines and can materially increases costs during already capital-intensive periods (mine construction or project development).

Investors typically penalize companies that rely heavily on issuing new shares as a means of financing. Furthermore, secondary offerings or the sale of additional shares is dilutive and punishing to shareholders. Simply, each new share dilutes the value of all existing ones. This dilutive effects destroy shareholder value and may not be a sustainable source of long-term capital. Royalty companies offer a compelling alternative, one that is less expensive and well-tolerated by investors. Their upfront payment in exchange for a share of the mine’s production benefits all parties involved.

NPR vs. NSI vs. Streaming Contracts

A royalty company’s negotiated contracts may vary and come in a few different styles. Ideally, a royalty company owns a diversified portfolio of contracts. As an investor, I like to see contracts that span different geographies and mining companies. This way the company isn’t dependent on a single mining operation’s leadership or exploration team. They also won’t be as heavily impacted if a foreign government nationalizes a mine or shuts one down. Common contracts include NSR (net smelter returns), NPI (net profits interest) and streaming contracts:

Net Smelter Returns (NSR): With an NSR contract, the royalty company has negotiated or purchased an existing contract where they will receive a percentage of smelter revenue, less refining costs, from the mining company.

Net Profits Interest (NPI): With an NPI contract, the royalty company has negotiated or purchased an existing contract where they will receive a percentage of profits from the mine.

Streams: With a streaming contract, the mining company agrees to sell a percentage of the metal produced from the mine at a discounted and fixed price per ounce. The physical metal received will then typically be sold immediately on the open market at the higher global spot price. The fixed price may be just that, or a discounted percentage of the floating spot price.

Under certain circumstances, a royalty company may also elect to receive equity interests in the mining company in lieu of payment or metal stream.

Corporate Structure

Royalty companies are a unique business in that the personnel requirements in relation to revenue are exceptionally low. In other words, revenue per employee trumps most other companies around the world. For example, Wheaton Precious Metals has revenue of $24,000,000 per employee. Compare that to, for example, Costco Wholesale which has revenue of only $770,000 per employee or Apple with revenue per employee of just $2.4m.

They operate, essentially, as a specialty finance company focused purely on precious metals; this royalty model offers highly favorable economics for a talented team or founder.

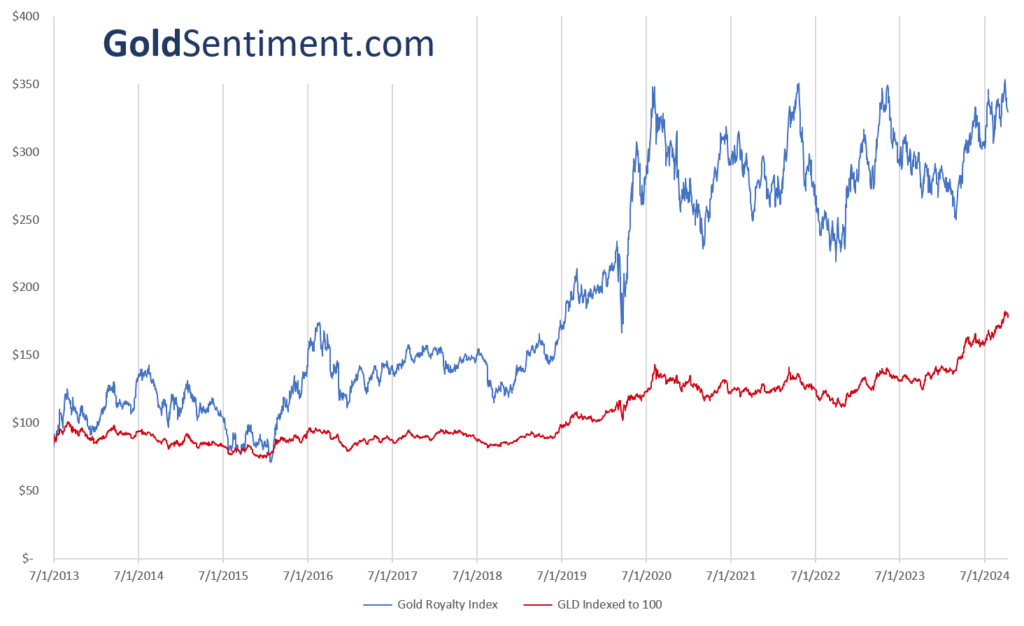

Gold Royalty Index vs. Gold Price

As with any asset, investors can push the price up or down to unreasonable values. Prices of an asset can, through persistent buying or selling, be brought out of sync with underlying value. This imbalance often creates periods of opportunity for savvy investors attuned to the price/value relationship. Simply put, if enough capital chases a good investment, it will cease to be a good investment. Gold royalty companies are no exception.

I need to be clear, royalty companies are not the same as gold. Although there is a logical and established relationship between the two assets, they are different.

To begin, one is a pool of contracts held within a corporation and the other is a physical commodity. Furthermore, the relationship between the price of gold and the value of a royalty company varies over time. This variation tends to fluctuate within an approximate and relatively focused historical range and can provide opportunity to attentive investors who monitor the relationship.

The below chart shows the relationship between our gold royalty index and the price of gold over the past 10 years:

Final Thoughts

Investors interested in allocating to precious metals have numerous options available. Each investment vehicle (bullion, a gold ETF, mining stocks, or royalty companies) has its own benefits and drawbacks depending on the investment environment and the individual investor’s goals and tolerances. However, in many cases gold and silver royalty companies appear to be a prudent investment. With that said, investors need to understand the risks associated with such an investment. As with all the vehicles listed above, the risks only begin with the price risk of gold and continue from there. An approximate risk/reward profile can be built around each option and an then a prudent investment allocation can be made.

Author

Andrew McCormick, RIA is the Senior Portfolio Manager at Cottonwood Capital Management. Previously, he worked for BlackRock and managed the MKC Global Fund, LP. Andrew’s work has been featured in ZeroHedge, TheStreet, and the Wall Street Journal.