Often overlooked, sentiment analysis provides investors with a unique and powerful insight into what’s happening within any market. Since every market is driven by investor demand (and the associated emotions), gauging this key factor can be quite powerful. Similar to the stock market, measuring gold sentiment can often be a key advantage for investors within the precious metals market.

Sentiment analysis is the black sheep of the investment analysis family. Understandably, most investors use fundamental analysis because they want to know why something should appreciate in value. This makes sense after all; understanding the “why” gives you confidence and makes an investor feel good.

How Does Gold Sentiment Analysis Work?

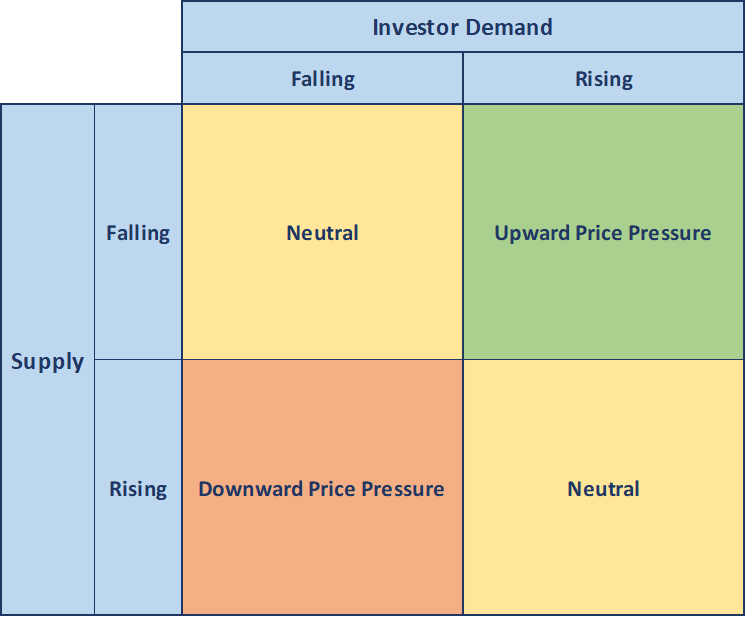

Economics 101 teaches the basics of supply and demand. If demand drops and supply remains unchanged, prices will decrease due to less buyer competition for the same amount of product. Conversely, if demand increases while supply stays the same then prices rise due to the imbalance.

The same holds for investors in a market.

Sentiment analysis is a way of gauging the demand within any market and is a powerful tool to understand. For example, if every investor in a market who wants to buy has bought, then who remains to do further buying? Nobody, and all else being equal, prices will fall as relative demand wanes.

Similarly, if all bearish investors have exited who remains to engage in additional selling? Nobody, and all else being equal, the selling pressure will abate and prices will rise or stabilize.

Using sentiment analysis isn’t tricky, buy figuring out how to gauge investors demand is harder.

Ultimately, if we accurately measure when investor appetite has peaked, we can exit a market before it declines. Conversely, if we can determine when selling pressure hits an extreme that is unsustainable, we can possibly identify a low-risk time to begin buying.

Investor sentiment, for trading and investment purposes, tends to be the most helpful when used in conjunction with other types of analysis (i.e. fundamental, technical, event-based, etc.). To be clear, sentiment analysis isn’t perfect though, markets can continue to decline during periods of very negative sentiment or continue to advance during periods of exuberant sentiment. This reality means that sentiment analysis is simply one more tool (albeit a powerful one) in your investment tool box.

Key Takeaways

- Sentiment analysis measures investor demand and, in doing so, helps identify important highs and lows within a market.

- Depending on the market, measures of sentiment data can be limited and investors may need to get creative.

- Markets can keep moving even though sentiment readings seem extreme, but used in conjunction with fundamental or technical analysis sentiment analysis can be valuable.

- Methods of sentiment analysis include polling, asset flows, CFTC position reporting (COT), and others.

How Can Investors Measure Gold Sentiment?

Investors often prefer fundamental analysis because the information is so readily available. As investors, we can find all the balance sheet information we want for a company on Yahoo! Finance, Reuters, the Wall Street Journal, or numerous other sources.

Technical analysis also has a broad following due to its perceived simplicity and widely available free charting options.

Unfortunately, sentiment analysis is trickier. These methods of measuring investor demand tend to be created by smaller organizations who either poll investors (e.g. are you bullish or bearish for the next 3 months?) or use their own proprietary data to measure demand (e.g. our own Gold Fear & Greed Index).

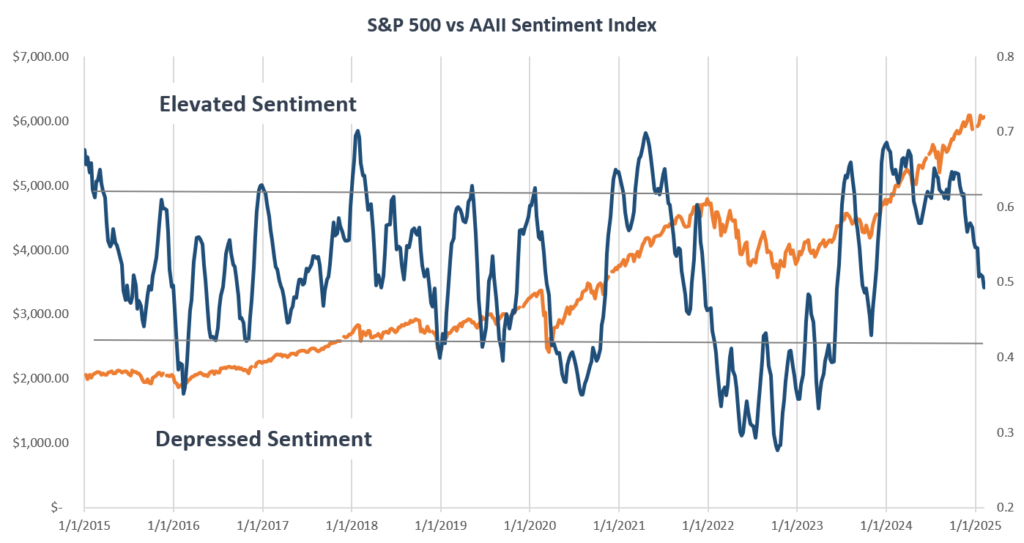

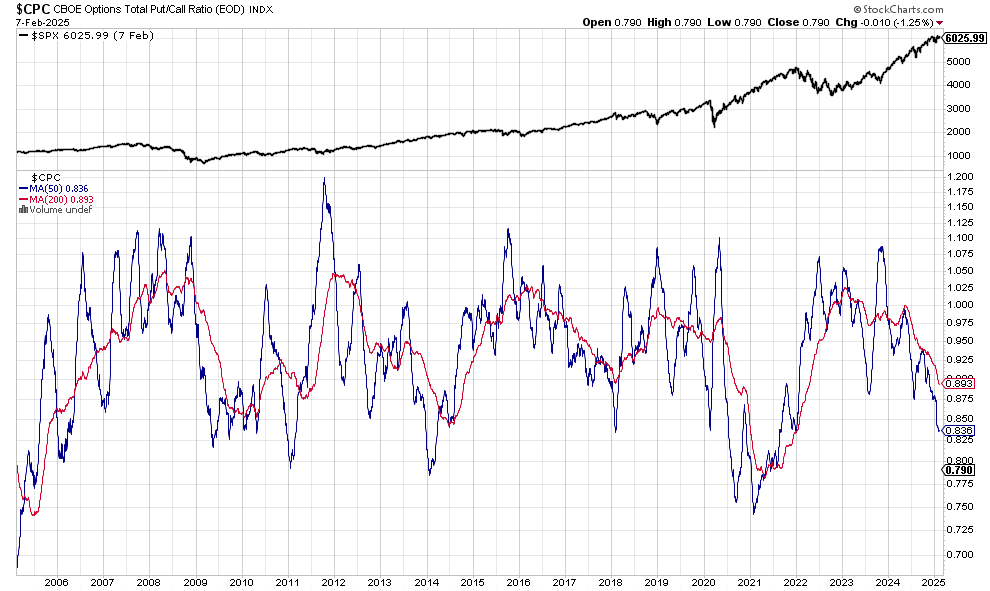

Fortunately, some publicly available sentiment measures exist. These include the stock market put/call ratios and the popular AAII Sentiment Survey.

Using Sentiment Analysis With Gold and Silver

Some markets lend themselves to sentiment analysis better than others. Markets with larger pools of investors and greater popularity tend to be easier to measure sentiment. After all, we need lots of investors to measure in order to gauge their collective “appetite”.

Luckily, gold and silver continue to be favored among investors large and small and therefore sentiment analysis often helps us in determining short-to-medium-term turning points.

Unlike stocks and bonds which have cashflows, dividends, or pay interest, gold just sits there. This simplicity means that investor emotion is even more important to understand. If investor sentiment is important with stocks and bonds then it’s doubly important for precious metals investors.

Investor sentiment is a much larger slice of gold and silver’s overall analytical landscape. In other words, knowing investor demand in the precious metals market can be very profitable.

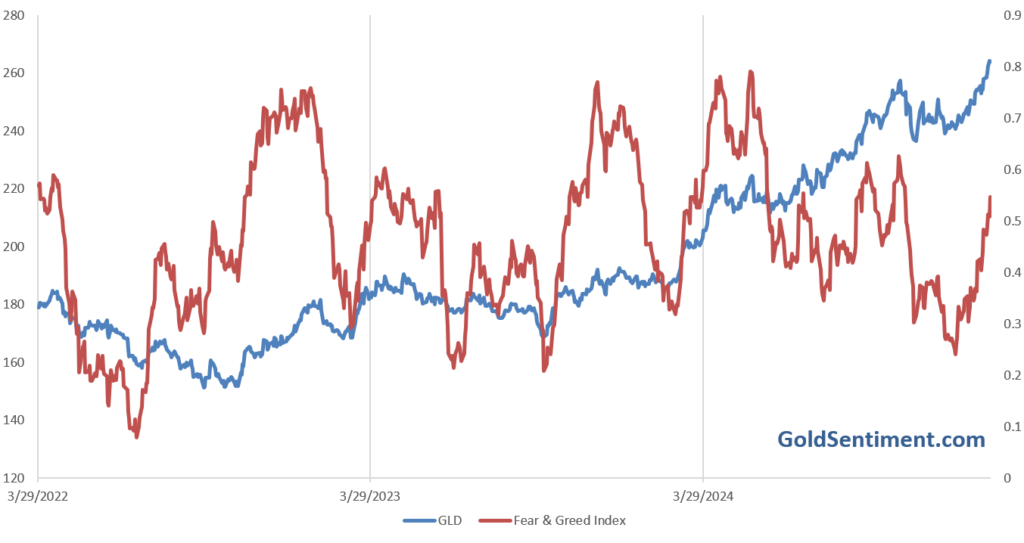

Our Gold Fear & Greed Index combines several different methods of measuring investor sentiment into a single index. Since no single method measures sentiment perfectly we use multiple different measures and combine them into a single index.

Examples of Types of Gold Sentiment Analysis

I mentioned earlier in this post that measures of investor sentiment aren’t widely available to investors. A few, like the ones I mentioned above, are free and available online. However, sentiment data for other markets is nearly impossible to find. Either because it doesn’t exist, or larger investment companies don’t publish them and instead use them exclusively in-house.

As far as measuring investor sentiment for gold and silver, investors have a few publicly available choices. I touch on a few below:

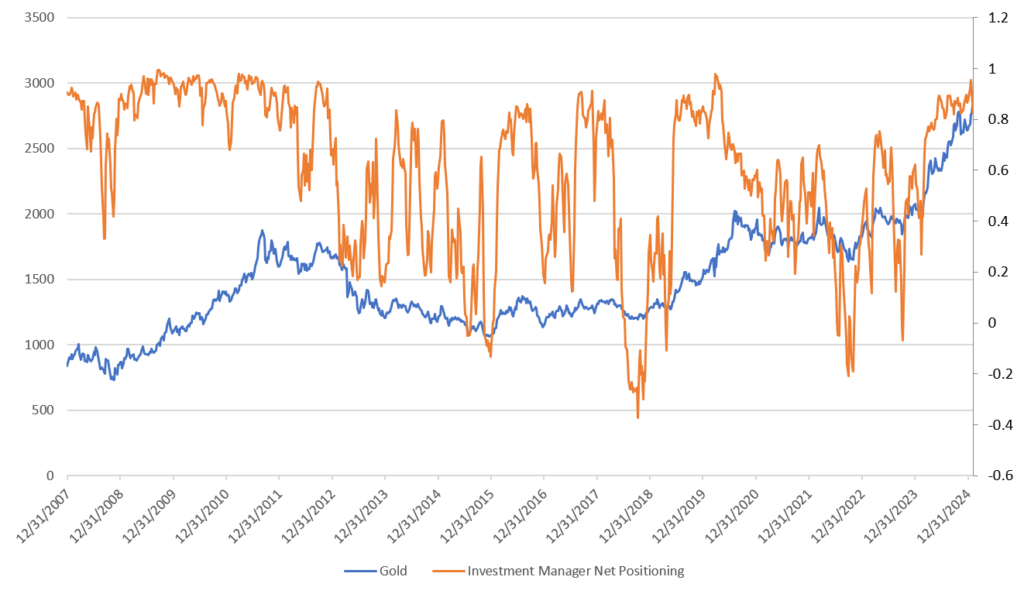

Commitment of Traders (COT)

COT stands for “Commitment of Traders”. The CFTC releases this data set for all futures markets on a weekly basis and it tells you exactly how many large traders are long or short any particular market at any time.

The report is dived between “Commercial” and “Non-Commercial” traders. In this instance, “commercial” traders are the producers, growers, and manufacturers. Furthermore, the “non-commercial” traders are the investment managers, hedge funds, and large-speculators.

As investors, we are concerned with the non-commercial traders and how they’re positioned.

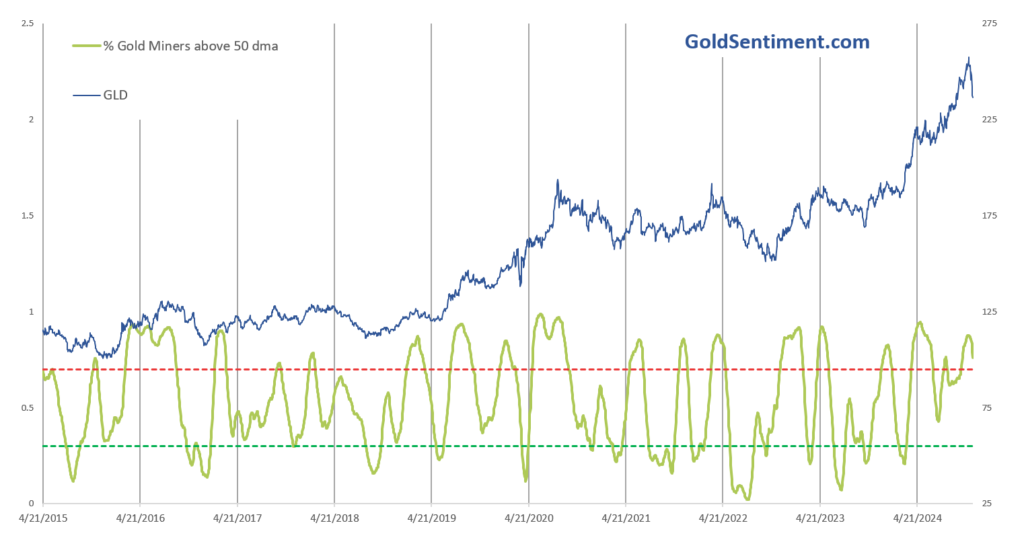

Diffusion Index

A diffusion index measures breadth or participation. For example, the S&P 500 shows you the average price of all 500 stocks. However, a diffusion index could show you what percent of the 500 were advancing in price or declining on any given day. Traders commonly look at a chart showing the percent of stocks trading above or below their 50 or 200 day moving averages as a rough measure of investor sentiment in the stock market.

We can do the same for gold mining stocks and, because they approximately track the price of gold, this can show a form of investor sentiment. This isn’t an exact tool by any means, but it’s one more way to evaluate the precious metals market.

Traders need to understand what they’re seeing when using a diffusion index. Rising levels indicate broader participation and declining levels indicate that a trend is being supported by fewer and fewer of the underlying companies. Alternatively, traders can view broad participation as a certain level of excitement and greed. Conversely, very low levels of participation as a indication of fear and avoidance.

GoldSentiment’s Fear & Greed Index

Our Gold Fear and Greed index is a thorough and proprietary combination of different measures of sentiment within the precious metals market. Since sentiment measures vary widely, combining multiple underlying ones can create a superior overall index. The individual models we use include but are not limited to COT, a diffusion index, fund flows, confidence levels and others. It’s important to keep in mind that even a sentiment composite like ours can’t be correct at all times. Investors must use other forms of analysis as well.

Conclusion

Ultimately, there are only so many major methods of analyzing a market: fundamental, technical, and sentiment analysis. To ignore on of the major methodologies is an easy way to handicap one’s analytical effectiveness. From another standpoint, like any method, sentiment analysis is not a holy grail and shouldn’t be used as the only way of deciding whether to buy or sell.

In practice, sentiment analysis can accentuate an existing framework of fundamental and/or technical analysis. In this vein, it’s important to devise some methods of measuring the sentiment with the market and incorporating that into your overarching market view.

Author

Andrew McCormick, RIA is the Senior Portfolio Manager at Cottonwood Capital Management. Previously, he worked for BlackRock and managed the MKC Global Fund, LP. Andrew’s work has been featured in ZeroHedge, TheStreet, and the Wall Street Journal.