In the dynamic world of financial markets, traders employ a countless number of strategies to profit from price movements. These include: fundamental analysis, sentiment analysis (e.g. gold fear and greed index), arbitrage and many others. Trend following is one particularly popular approach when investing in gold, silver and other markets.

This method hinges on the principle that markets, like gold and silver, tend to move in sustained trends (up or down) and it seeks to profit from these directional movements. Let’s delve deeper into the history, mechanics, and the pros and cons of trend-following in trading.

History of the Trend-Following Strategy

The roots of trend-following likely go back hundreds of years. For example, we know the famed Jesse Livermore utilized some technical analysis and trend-following strategies back in the 1920s when trading stocks and commodities, like cotton.

More recently, trend-following pioneers like Richard Donchian, Richard Dennis, and Ed Seykota contributed to its development, refining methods and strategies that are still relevant today. Their work began and hit its stride in the volatile and inflationary period of the 1970s when gold, silver, and other commodity prices would move up and down in dramatic fashion. Consequently, some traders made many times their money during gold’s advance in the 1970s.

Most famously, the Turtle Traders, used simple but effective trend-following strategies to generate tremendous returns of 40-50% per year for many years during the 1970s and 1980s. As the years progressed and the most simple methods of trend following became well-known the profits became more difficult to extract. For example, the 1980s witnessed lower volatility and lower gold prices making gold trend following much less profitable.

How Trend Following Works

At its core, trend-following involves identifying the direction of gold’s price trend and taking positions that align with that trend. A simplified step-by-step guide to implementing a trend-following strategy would include the following:

- Identifying the Trend: Traders use technical analysis to determine gold or silver’s prevailing trend direction (upward, downward, or sideways).

- Entry Points: Once gold’s price trend is identified, traders look for entry points that confirm the continuation of the trend. This could be a breakout above a resistance level in an uptrend or a breakdown below a support level in a downtrend.

- Setting Stop-Losses and Targets: Risk management is crucial in trend-following. Traders typically set stop-loss orders to limit potential losses if the trend reverses and set profit targets to lock in gains as the trend progresses.

- Monitoring and Adjusting: Gold’s price trends can change or reverse suddenly. For this reason, active monitoring of positions and adjusting strategies accordingly is essential. Some traders use trailing stop-loss orders to protect profits as the trend develops.

Assets, Time Frames, and Pit-Falls

A trend-following strategy can be used with gold or silver and applied across any time frame. Investors will find futures contracts or gold ETFs are the best vehicles to use for this type of trading. Selling and buying physical gold coins or bars, although a great way to invest in precious metals, is cumbersome for this type of trading. Some traders use these methods intra-day and others are focused on multi-year trades. It’s important to find the time frame that you are comfortable with and can stick with.

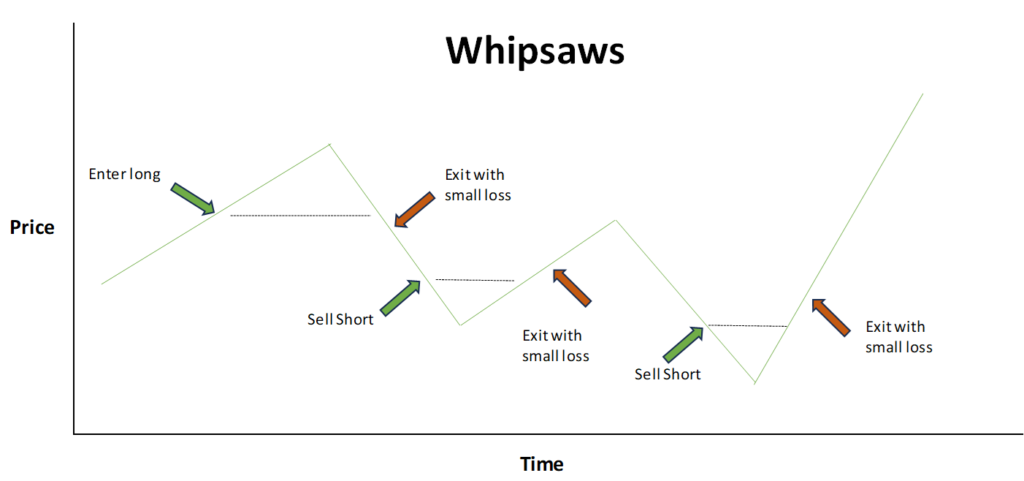

Consistency is key and, like most things in investing, trend-following has trade-offs. The benefit of only using a simple mechanical strategy is offset by the many failed trends known as “whipsaws”. Whipsaws are trends that start and then reverse, resulting in a small loss. Profitable trend-following strategies will often have only 30-40% winning trades. The remaining trades result in a small loss, but several of these in sequence can add up and start to degrade a trader’s confidence in their strategy.

Pros of Gold Trend Following

- Profit Potential: Trend-following can generate substantial profits during strong and sustained price movements.

- Clear Rules: A proper trend-following strategy provides clear entry and exit rules based on objective technical indicators, which helps in decision-making.

- Diversification: It can be applied across all assets and timeframes, offering diversification benefits.

- Emotion Control: By relying on technical signals rather than emotions, gold trend-following helps traders avoid impulsive decisions.

Cons of Gold Trend Following

- Whipsaw Risk: During choppy or range-bound markets, false signals can lead to losses as gold prices fluctuate around moving averages or trendlines.

- Late Entries and Exits: Trend-following strategies may result in entering a precious metals trend late or exiting too soon, missing potential profits.

- Psychological Challenges: It requires discipline to stick to the strategy during periods of drawdowns or when facing consecutive losses.

- Market Changes: Precious metals trends can be less pronounced or shorter-lived in certain market conditions, reducing the effectiveness of the strategy.

Sample Gold Trend Following Strategy and Results

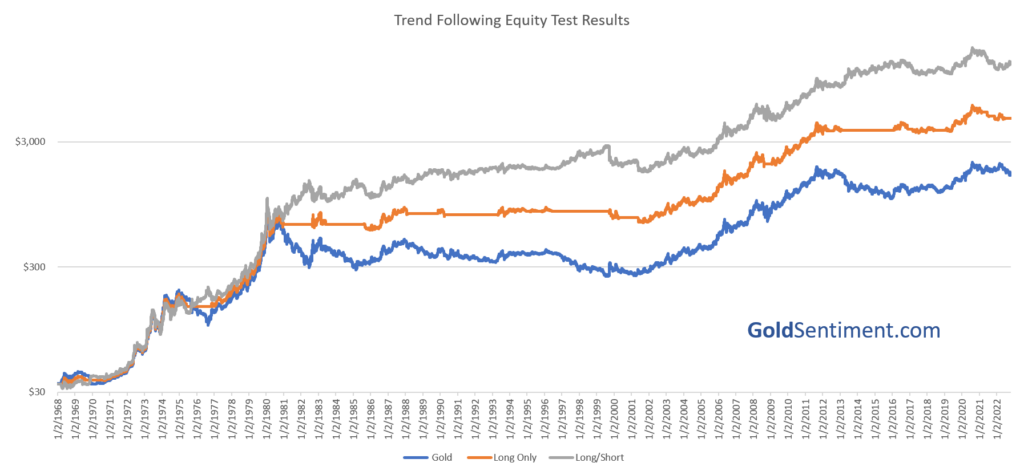

Utilizing a trend following strategy on gold can be a profitable way to invest in the market over the long-term. These strategies come in numerous flavors and styles and can be used over any time frame, from hours to months. To illustrate performance possibilities, we’ve included a backtest of our model on gold. Look below to see three equity curves: only buy (long) signals, long and short signals, and the cash price of gold for performance comparison purposes.

Following this sample trend strategy would require patience and consistency. The system used in this example had no stop loss in place and system results don’t include slippage or commissions.

The above chart shows system signals (yellow shading is long, white is short). We added a simple triple-moving average model for visual effect.

In conclusion, using a trend-following strategy to invest precious metals remains a valuable trading strategy. This is due to its simplicity and potential for capturing significant market moves. However, like any strategy, it comes with inherent risks and requires adept risk management and discipline. By understanding history and applying strong risk management, traders can harness the power of this trading strategy.

Author

Andrew McCormick, RIA is the Senior Portfolio Manager at Cottonwood Capital Management. Previously, he worked for BlackRock and managed the MKC Global Fund, LP. Andrew’s work has been featured in ZeroHedge, TheStreet, and the Wall Street Journal.