For many, the thought of gold bars stir up thoughts of treasure, untraceable asset movements, or even a railroad-era heist. Gold bars may play a role in each of these fanciful scenarios, but in reality, gold bars play an important role for investors around the world.

Simply an efficient tool for those with sufficient assets, gold bars assist with the logistical headache of storage and movement of precious metals assets. For example, moving a single 100oz gold bar is far easier than tracking one hundred individual 1 oz gold coins or a combination of small gold and silver bullion pieces. For wealthy investors or large institutions, gold bars simplify the process of physical bullion investing.

Gold Bar Sizing and Composition

Compared to the intricacy of a sovereign gold coin, any refiner with the proper equipment can produce a gold bar. For this reason, a myriad of bars exist: different sizes, from different refiners, from different time periods throughout history.

However, most commonly, investors will find 1oz gold bars, 10oz gold bars, kilogram gold bars, and 100oz gold bars. These remain the most common but if you look hard enough obscure and irregular bars will surface from time to time.

1 oz gold bars tend to be simply an alternative to purchasing a 1 oz gold coin. Different, often more pure, but really not materially different for purposes of investing. Many sovereign coins are not 100% pure gold but a high-karat alloy (91.67% for the U.S. Gold Eagle and South African Krugerrand). However, nearly all popular gold bars are 99.99% or higher pure gold.

Nearly all of the mainstream mints produce the popular 1-oz gold bars due to their popularity with smaller investors. Fewer produce the larger 10oz, kilo, and 100 oz bars.

Additional Gold Bar Information

Gold Bar Inscriptions and Production Methods

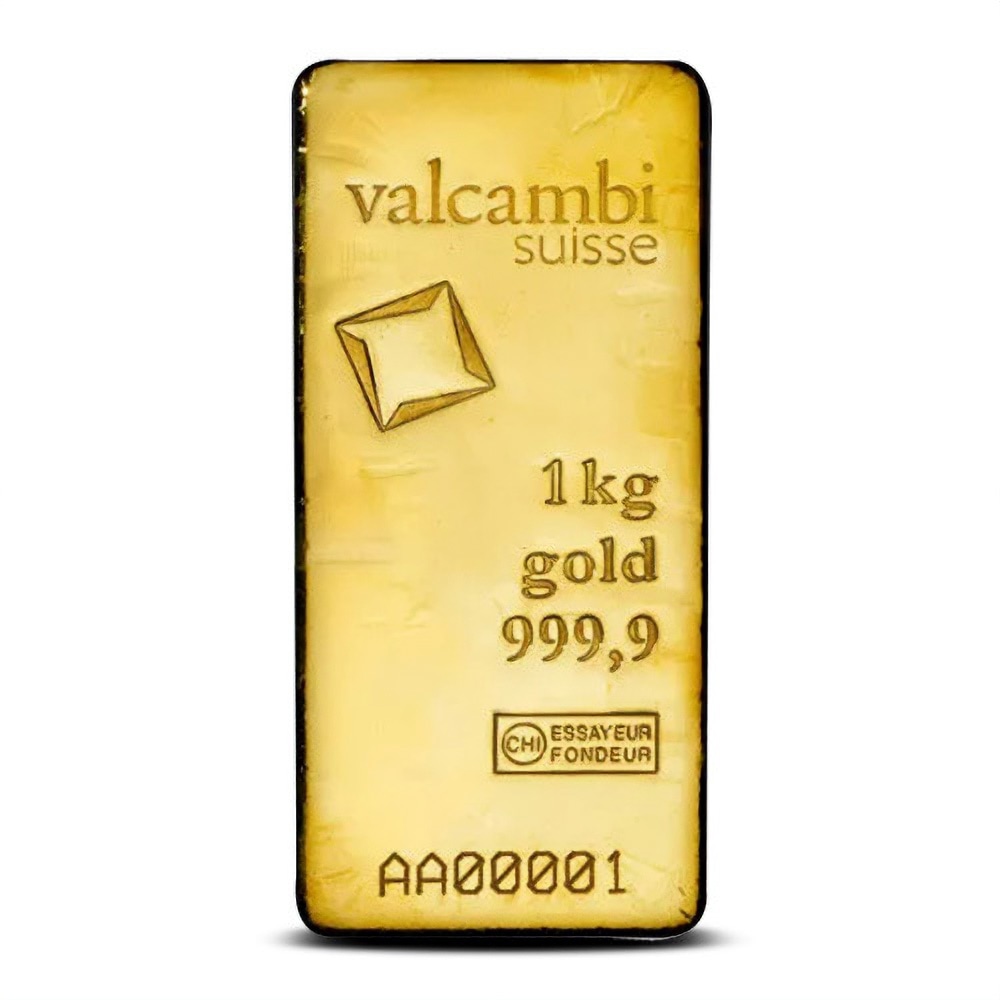

Gold bars, regardless of size, are typically stamped with three markings: purity, weight, and the refinery’s insignia.

Furthermore, refineries produce bars through either casting or minting. Casting occurs when a refinery pours molten metal into a mold that shapes the bar to specific dimensions. A minted bar is cut from a larger sheet of the precious metal. For example, minted coins get punched from a larger sheet of metal and then struck with a die to generate the detailing on each face. The same process holds for a minted 1 oz bar.

It’s difficult to tell whether a 1 oz bar was cast or minted but certain traits can help determine how it was produced. Many times, a cast bar will have an uneven surface and lack the perfect smoothness and uniformity of a minted bar. Also, as molten metal is poured different sections cool at different rates and on larger bars ripples or something akin to tree rings are visible. Often these bars are more sought after by investors and collectors. Gold and silver will sometimes be cast whereas minting will be used for gold, silver, platinum, palladium, and rhodium.

Did You Know?

99.9999% (six nines fine) is the purest gold ever produced. This was refined by the Perth Mint in 1957.

Purity and Fineness of Gold Bars

Another differing factor for gold bars is their millesimal fineness. This system indicates the purity of a metal, most notably gold, silver, platinum, palladium and is based on the percentage system. For example, 75% gold is denoted as “750” and 99% gold is denoted as “990”. The typical purity of a 1oz gold bar is 99.9% pure gold which investors will see punched into the bar as “999” or “.999”. No industry is free from its share of jargon and in the refining industry this level of purity is sometime referred to as “three nines fine”.

Gold Bar Anti-Counterfeiting Technology

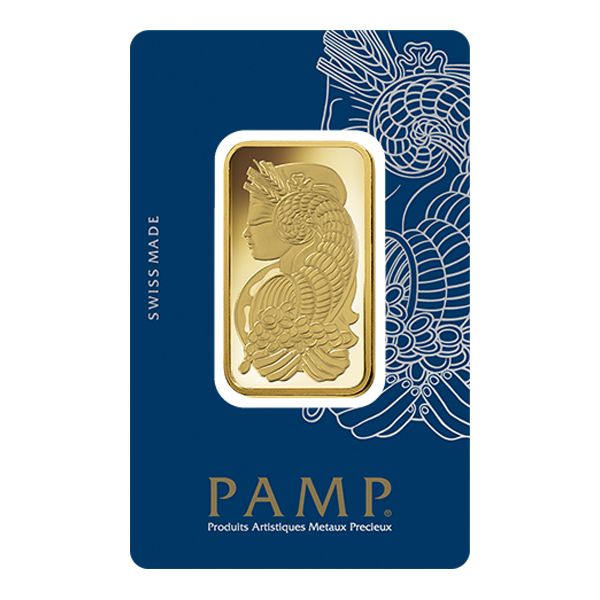

After hundreds of years of gold bars living in the analog age they recently entered the digital one. In an effort to combat fraud, refiners continue to incorporate technology into their security features. For example, the Argor Heraeus’ Kinebar uses a digital fingerprint and Pamp Suisse includes a scannable QR code called Veriscan. Additionally, Valcambi uses four vector symbols (< > v ^ ) imbedded into the gold bar as a part of its anti-counterfeit efforts.

Gold Bars vs Gold Coins

The debate between gold coins versus bars will likely continue for eternity. Part of the answer simply comes down to preference. The answer also distills down to security, funding, holding period, and efficiency.

Preference

Enjoyment and independence drive much of the desire to hold physical gold or silver. With these motivators satisfied by holding physical precious metals then the form doesn’t really matter, personal preference simply drives the last mile of the pursuit. For example, do you enjoy looking at coins or does the simplicity of a bar – the satisfaction of a chunk of gold – please you more?

The numerous mints around the world all generate many different individual coins. A collector/investor will find a huge selection to choose from and enjoy. In all, there may be a thousand different coin options, in varied fractions of an ounce, to choose from. Conversely, bars offer less selection but are seen as more purposeful and less “playful”.

Which will you choose?

Gold Bar Security and Purity Concerns

If one were to try and defraud a precious metals investor, your energy and time would be better spent manipulating a piece that was lacking detail and large. A criminal organization would generate large illicit gains by selling a tungsten-filled kilogram gold bar than a U.S. gold buffalo coin. It would be easier as well – drilling into a bar requires few specialty tools whereas hollowing out a thin coins with intricate carvings seems nearly impossible to do without destroying the coin or its engravings.

For this reason alone, most investors favor coins due to their built-in security. However, security concerns don’t need to remove bars from consideration entirely. Instead, the concerns are justified but can be alleviated through simple testing options. For example, investors can use a combination of methods to ensure that a bar is pure gold. These include, weighing, conductivity analysis, testing magnetism, and ultrasound testing.

Funding

Funding simply refers to whether or not the investor has the capital to purchase a gold bar. With that being said, investors who consider purchasing a 1 oz gold coin are equally able to purchase a 1 oz gold bar. However, the larger 10oz, kilogram, and 100oz bars require substantial funds and are a limiting factor for many smaller investors.

Holding Period

Holding period may be less of a concern in today’s world than in the past but it’s still a consideration. For an investor focused on holding physical precious metals for a decade or longer the format doesn’t matter quite so much. Unlike a long-term holder, an investor who may sell their gold or silver in a few months or one year may want a popular coin instead. By definition popular products are more desirable and easier to sell.

However, if purity can be assured, gold is gold regardless of format. Fortunately, recent innovations have made assuring purity much easier, especially at the 1oz bar size. For example, Pamp refinery introduced their Veriscan product. Many refineries began sealing their 1oz gold bars in plastic with an assay certification card, Pamp included. However, Pamp included a scannable QR code for individual bar verification. These added layers of security make selling a 1oz gold bar a safer endeavor.

Gold Bars are Efficient

Finally, and applicable to large institutions only, the logistics of owning hundreds of individual coins is impractical. For investors seeking to build a position of, let’s say, $100m in gold, they’ll likely opt for a small palate of 100oz bars rather than 40,000 individual coins or small 1oz bars. As an added benefit to these large investors, 100oz bars are rated as good for delivery against CME gold futures. CME gold futures provide additional options in the event they choose to sell in the future.

Gold Bar Refineries and Mints Around the World

Gold coins can be fun to collect and research due to the large quantity of designs and choices. However, often refineries, instead of mints, around the world produce bars. Some of these can be enjoyable to own as they’re a bit more unique and some, historical. For example, several refineries trace their roots back 100-200 years. Refineries like Metalor (founded 1852), Johnson Matthey (now Asahi, founded in 1817) and the Rand refinery (founded 1920) offer a piece of history in addition to their bar products.

Gold bar producing refineries:

Popular:

Valcambi

Pamp

Sunshine

Asahi

Royal Canadian Mint

Perth Mint

The Royal Mint

Scottsdale

RCM

Rand

Less well-known:

Metalor

Engelhard

Argor Heraeus

Italpreziosi

Texas Mint

Apmex

Geiger Edelmetalle

American Reserve

C. Hafner

Umicore

Some of these fall more under the monetary or finance umbrella whereas others really are more industrial companies. In this light, the Royal Mint focuses solely on minting coins and producing bars for investment. Conversely, a company like Umicore engages in metals recycling, producing chemicals, optics and display production in addition to precious metals refining and bar production.

Investors can find some satisfaction in knowing the different refinery and mints around the world and owning different bullion products from each. This investing form is more personal, hands-on, and interesting for many.

Most Popular Gold Bars

1oz Gold Bars:

1. Valcambi 1oz Bar in Assay

2. Pamp Suisse Lady Fortuna 1oz Bar in Assay

3. Royal Canadian Mint 1oz Gold Bar in Assay

4. Perth Mint 1oz Gold Bar in Assay

5. Asahi 1oz Gold Bar in Assay

6. Sunshine Minting Gold Bar in Assay

7. The Royal Mint 1oz Gold Britannia bar in Assay

10oz Gold Bars:

1. Valcambi 10oz Gold Bar

2. Perth Mint 10oz Gold Bar

3. Johnson Matthey 10oz Gold Bar

4. Credit Suisse 10oz Gold Bar

5. Pamp Suisse 10oz Gold Bar

Kilo Gold Bars:

1. Valcambi Kilo Gold Bar

2. Perth Mint Kilo Gold Bar

3. Royal Canadian Kilo Gold Bar

4. Argor Heraeus Kilo Gold Bar

5. Pamp Suisse Kilo Gold Bar

Pros and Cons of Gold Bars (vs coins)

Ultimately, the choice to invest in one type of gold bar versus a different one boils down to personal preference. However, the choice to purchase a gold bar instead of a gold coin, or gold ETF, or shares of a gold mining company remains more nuanced. All have their advantages and disadvantages and some options remain better for some investors compared to others.

However, those caveats aside, below summarizes the pros and cons for gold bar ownership relative to the alternatives:

Pros

Cons

Efficient for large investors

Less interesting than some of the sovereign coin options

Interesting & unique global refinery options

Additional work to verify purity and no presence of fraud

Satisfying to own and hold

Depending on size and refinery, may be more complicated to sell

Quintessential gold bullion format for the serious investor

Fewer refinery options for large bars

Now quite secure with assay certificates and QR codes

100 and 400oz bars can be very difficult to source through retail channels

Purity can be guaranteed with modern testing methods

Unlikely upside for secondary-market premiums at time of sale

Zero counterparty risk

Simple to sell

Lower premium, compared to coins. Least expensive way, by weight, to purchase gold

Where to Purchase Gold Bars

Part of the appeal of 1oz gold bars is their wide availability. To this point, investors can easily purchase these beautiful and valuable bars from local coin stores and through online gold dealers. Importantly, we spend hours each month researching the different online gold dealers and you can review our online gold dealers reviews page for additional information.

Making such a large purchase online can feel uncomfortable but purchasing through online dealers has become the standard for many investors. Moreover, these are large businesses (some of them are public companies) with millions of visitors each month. In terms of selection and pricing they are very tough to beat.

Conclusion

Ultimately, gold bars remain an excellent investment option for those looking to allocate to precious metals. They’re widely accepted and concerns around fraud and impurity are being addressed by packaging technology by the refiners. Furthermore, technology helps the investor and intermediary dealers confidently confirm purity through various means, most notable ultrasound and conductivity testing.

In the end, choosing bars or coins or some other means of investing in precious metals comes down to preference. Numerous global refineries exist, each with various products sure to satisfy the passionate collector and investor.

Author

Andrew McCormick, RIA is the Senior Portfolio Manager at Cottonwood Capital Management. Previously, he worked for BlackRock and managed the MKC Global Fund, LP. Andrew’s work has been featured in ZeroHedge, TheStreet, and the Wall Street Journal.